Key takeaways

- Bitcoin is a decentralized digital asset. It was launched in 2009 by Satoshi Nakamoto, an unknown entity, as a response to bank failures of the 2008 financial crisis.

- Bitcoin is a digital cash solution that removes the need for third party intermediaries (like banks) that are required to facilitate transactions, allowing you to own your money and send/receive it in a peer-to-peer (p2p) manner.

- Although Bitcoin was created to be a new form of money, its various upgrades (SegWit, native SegWit, taproot) have unlocked newer, exciting use cases such as Bitcoin non-fungible tokens (NFTs), Bitcoin Name Service (BNS), and more.

What is Bitcoin?

Bitcoin is a decentralized digital asset. It was invented in 2008 by Satoshi Nakamoto, an anonymous developer, as a response to the traditional financial system bailing out failed banks. The idea was to create a new form of money, or “peer-to-peer electronic cash system,” fully owned by its participants and outside the control of centralized entities, such as governments and banks. To pull this off, Satoshi developed (1) bitcoin, the currency and (2) Bitcoin, the network.

Bitcoin, the currency (denominated as BTC) is a decentralized cryptocurrency (or digital asset) with a capped supply of 21 million (of which ~19 million have already been mined). As mentioned above, BTC was invented to be a form of money, but now it acts more as a store of value. Like gold. Due to its scarcity, bitcoin can protect your purchasing power and hedge against inflation. However, unlike gold, bitcoin is hard to confiscate and easy to “transport” and transfer. This is due to Bitcoin, the network.

Bitcoin, the network, is a peer-to-peer (P2P) network of computers (and the people behind them) that run the Bitcoin protocol (the set of rules for sending and receiving bitcoin). This network maintains the public, decentralized database (the Bitcoin blockchain) that tracks the creation, ownership, and transfer of bitcoin, the currency. To ensure that the database is accurate, the computers verify that each update follows the rules of the Bitcoin protocol. If it doesn’t, it’s ignored. If all computers agree, it’s accepted. This happens through a process called proof-of-work (PoW).

Proof-of-Work (PoW) is Bitcoin’s consensus mechanism. It’s what makes Bitcoin possible. Because it doesn’t have a centralized body, Bitcoin relies on its decentralized network of computers to verify transactions. These computers (or “miners”) compete to solve complex mathematical puzzles to verify new data, and the first to solve them earns newly-created bitcoin (in a process known as “mining”). This mining process secures the network, removes the need for a trusted third party, and enables the creation of new bitcoin.

Now, let’s sum things up. Through the combination of its virtual currency, decentralized network, public database, and PoW consensus mechanism, Bitcoin developed a new alternative financial system free of centralized authorities and middlemen.

What can you do on Bitcoin?

Although Bitcoin was created to be a new form of money, its various network upgrades (SegWit, native SegWit, taproot) have unlocked newer, exciting use cases: Bitcoin non-fungible tokens (NFTs), Bitcoin Name Service (BNS), and more. But before we dive into these newer use cases, let’s cover Bitcoin’s primary purpose—finance.

Decentralized Finance (DeFi)

Bitcoin is a decentralized financial (DeFi) system. When you buy BTC (and, thus, join the Bitcoin network), you begin to participate in a new form of money. One in which the rules are clear and you own your money. Not governments or banks. This allows you to…

Save and invest BTC

Unlike fiat currencies—which can be issued at will and lose value over time—bitcoin has a fixed, capped supply. There will only ever be 21 million. And no person, organization, bank, or government can change this. Due to this, some people see bitcoin as a savings vehicle and others see it as an investment.

In developing countries, with low economic and political stability, some citizens resort to bitcoin to protect their money from hyper inflation and government oppression. With just their secret phrase (a series of 12-24 words), they can store their money somewhere that can’t be confiscated—in their mind and on the Bitcoin blockchain.

In the developed world, Bitcoin is most often treated as an investment. Due to its fixed, capped supply, Bitcoin is scarce. It’s also governed by the law of supply and demand. So, if interest continues to rise, from retail and institutional investors, the price will too. With this in mind, many investors are pouring money into this digital asset to benefit from the expected appreciation and diversify their portfolios.

Send and receive BTC

Bitcoin’s global decentralized network makes it useful for transferring money. With a crypto wallet, you can send and receive bitcoin to and from anyone else on the Bitcoin network no matter where they are. 24/7. You just need their Bitcoin address.

Here’s how to send BTC:

- Insert your recipient’s Bitcoin address

- Choose how much you want to send

- Press ‘Send’

For expats and immigrants, Bitcoin is particularly useful for remittances. Due to its fast and cheap payments, sending money across borders is better with Bitcoin. You avoid foreign exchange and international transfer fees and delays from bank holidays and weekends. This means the money gets to you and your loved ones when it’s needed, not when the banks decide.

Ordinals (Bitcoin NFTs)

Long before Ethereum and Solana became known for non-fungible tokens (NFTs), Bitcoin was the site of early NFT history. Projects like Colored Coins and Rare Pepes pioneered the digital art movement and paved the way for future NFT innovation. Although NFT activity on Bitcoin largely cooled down after this, it saw a resurgence in early 2023 with Ordinals, a novel form of NFTs native to the Bitcoin network. This development, by Casey Rodarmor, reinvigorated NFT development on Bitcoin and led to new fun use cases. Here are a few:

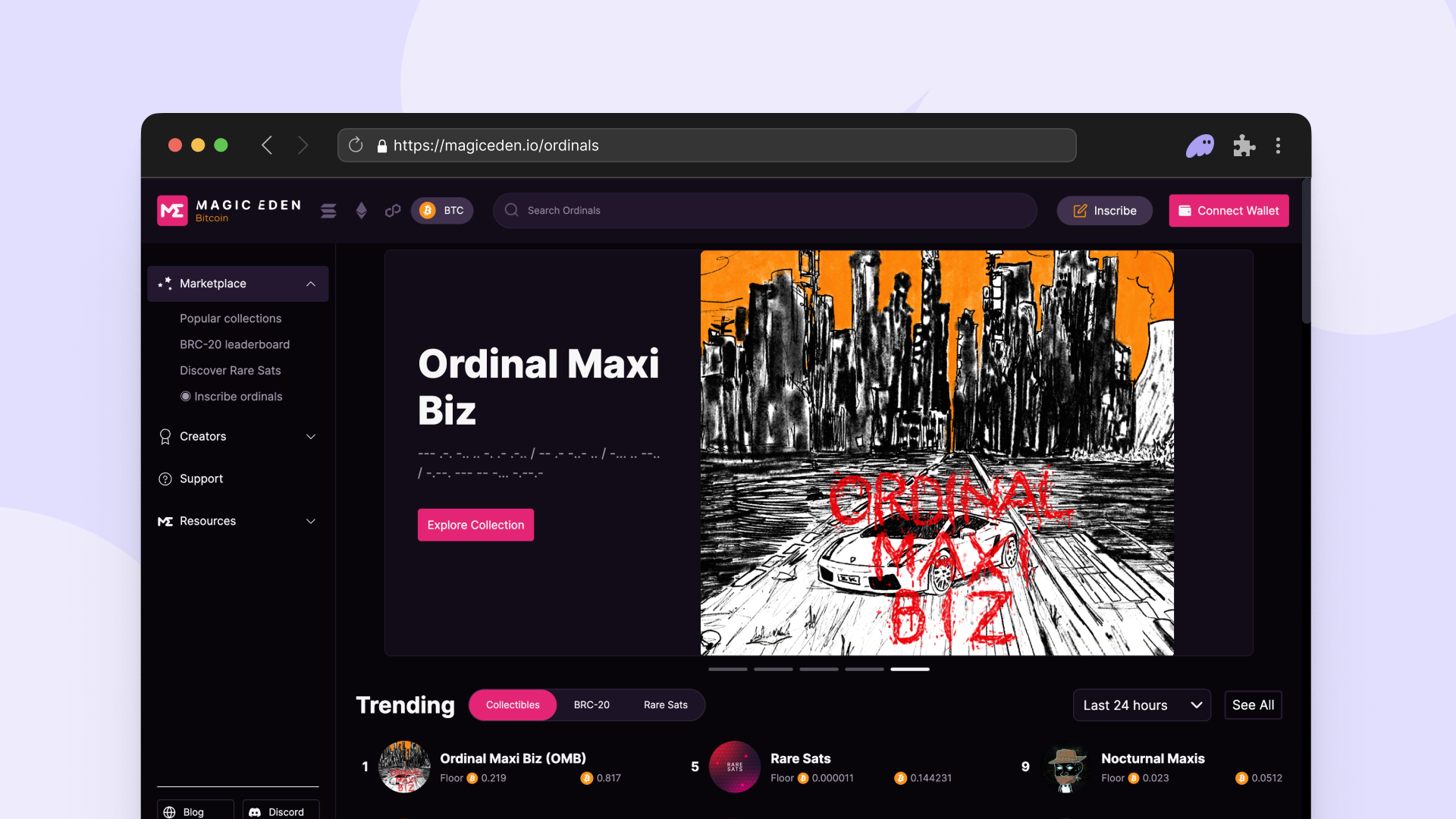

Buy, sell, and trade NFTs

Gone are the days of only HODLing bitcoin. Now, you can engage in NFT-related activities on Bitcoin too. On marketplaces such as Magic Eden, you’ll browse, buy, sell, and trade Bitcoin NFTs. As you do so, you’ll use your Phantom wallet to connect to the marketplace, fund your wallet, and store your NFTs. The best part? It’s seamless and secure.

Explore the top ordinals

It can be hard to know where to start when it comes to ordinals. Fortunately, ordinals explorer Ord.io makes it easy. With Ord.io, you can browse, filter, and discover inscriptions, and interact with others that are doing the same. Think of it as social collecting. You explore the best of bitcoin—the top images, GIFs, videos, text, games, and more—and react, reply, comment, and upvote your favorites.

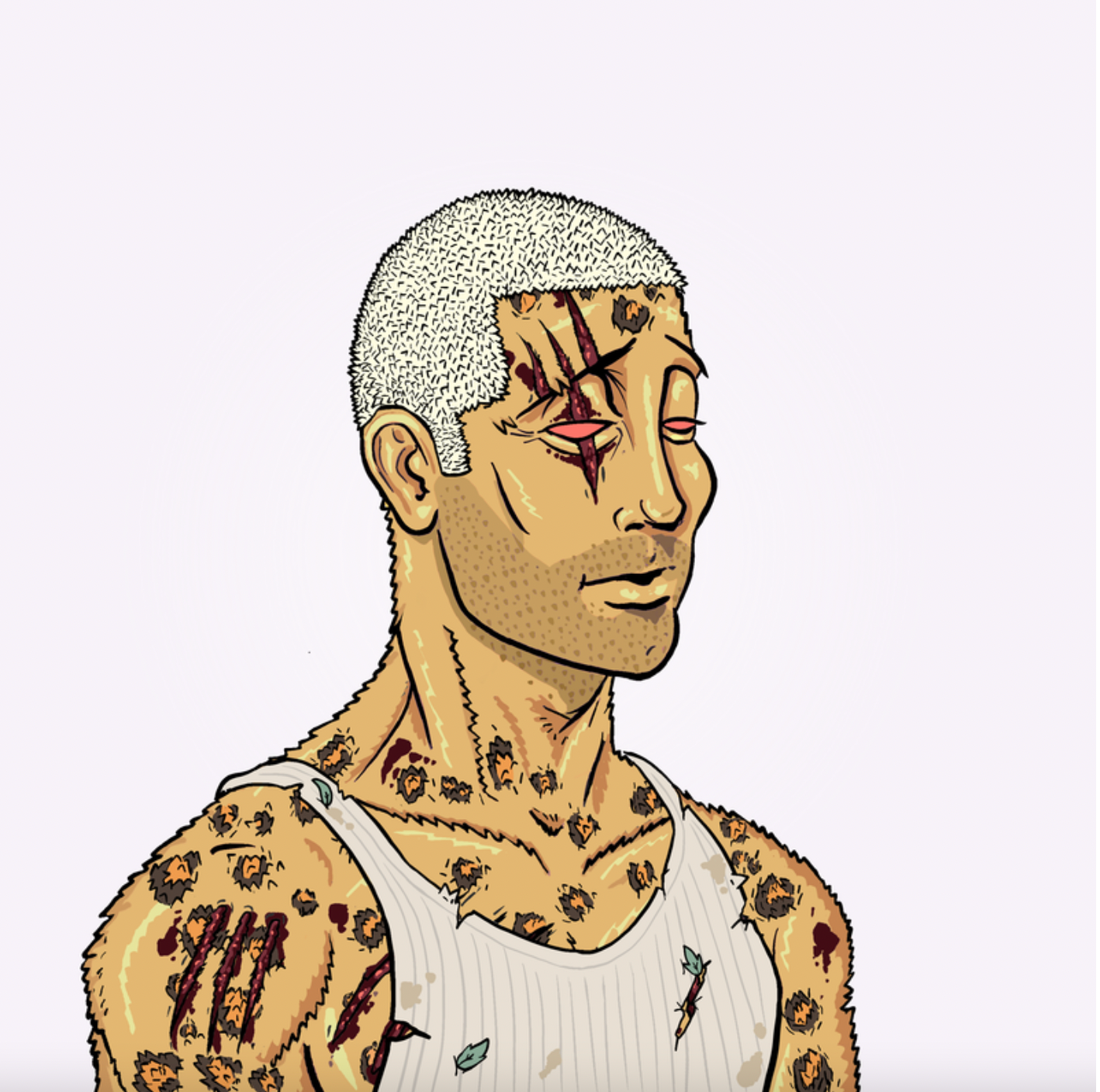

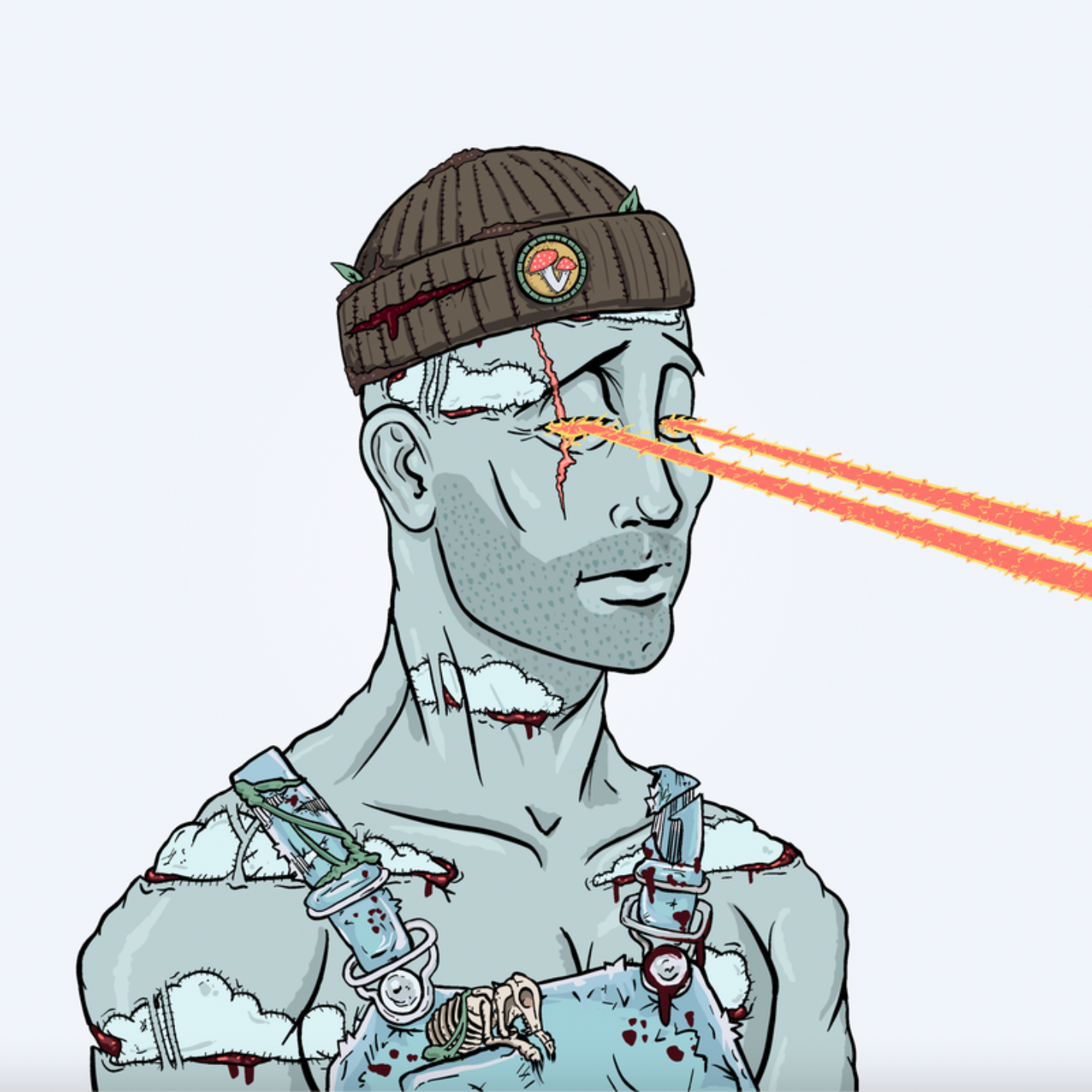

Collect NFTs from major projects

Like Ethereum and Solana, you can collect NFTs on Bitcoin. Some collections are unique to Bitcoin, such as Bitcoin Frogs and OMB, and others are famous projects that expanded to Bitcoin, such BTC DeGods and Okay Bears. To help you get to know these projects better, here’s an overview of each.

BTC DeGods

BTC DeGods is a collection of 535 godly PFPs on Bitcoin. Originally created on Solana, and later burned as a tax against paper-handed owners, DeGods revived these NFTs to launch on Bitcoin. To pull off the bridge, DeGods worked with Bitcoin miner Luxor Technologies to recreate all 535 NFTs in one single block: block 776408.

Okay Bears

Okay Bears (OKB) is a multichain 10K PFP collection. First launched on Solana, and later on Bitcoin, this cool collection of bears is building “a virtuous community that transcends the internet into the real world.” How? Through its family-friendly brand, notable partnerships and charity work, and web3-native innovation.

Bitcoin Name Service (BNS)

Bitcoin Name Service is a decentralized naming database on Bitcoin that supplies simple usernames that end in “.btc.” With these human-readable usernames, you can send and receive bitcoin and ordinals without dealing with long, complicated wallet addresses. Why does this matter? Because it’s faster, easier, and less prone to error. You don’t need to memorize complex wallet addresses or deal with the anxiety of inputting them correctly, character by character.

Another cool aspect of BNS is that it’s customizable. Similar to website URLs or social media usernames, you can choose your username. DiamondHandz.btc? PayMeInBitcoin.btc? HODLgod.btc? Whatever name you want, it’s yours—as long as it’s available. This allows you to create and manage your digital identity, and shape how you’ll be perceived on the internet.

Summary

Satoshi Nakamoto invented Bitcoin in 2008, and launched it in 2009, due to the shortcomings of the traditional financial system. As the first cryptocurrency, Bitcoin pioneered decentralization by combining software, hardware, cryptography, and mining. Although Satoshi created Bitcoin to be a peer-to-peer electronic cash system, it has evolved into something more. Today, Bitcoin is seen as “digital gold,” and thanks to various network upgrades, its blockchain now supports Bitcoin NFTs, Bitcoin Name Service, and other novel use cases.