In the loan world, sharks have a bad rap. But Sharky is changing that. The NFT-lending program offers impressive interest rates and favorable terms to lenders and borrowers. But it goes deeper than that. So, let’s dive in.

What is Sharky?

Sharky is a lending protocol—with a live open order book—for short-term loans backed by Solana NFTs. It connects people who need immediate access to crypto (borrowers) with people looking to provide crypto for a healthy return (lenders). To receive a loan, borrowers must lock up their NFT until the loan is paid back (plus interest). If they fail to repay, the NFT transfers to the lender.

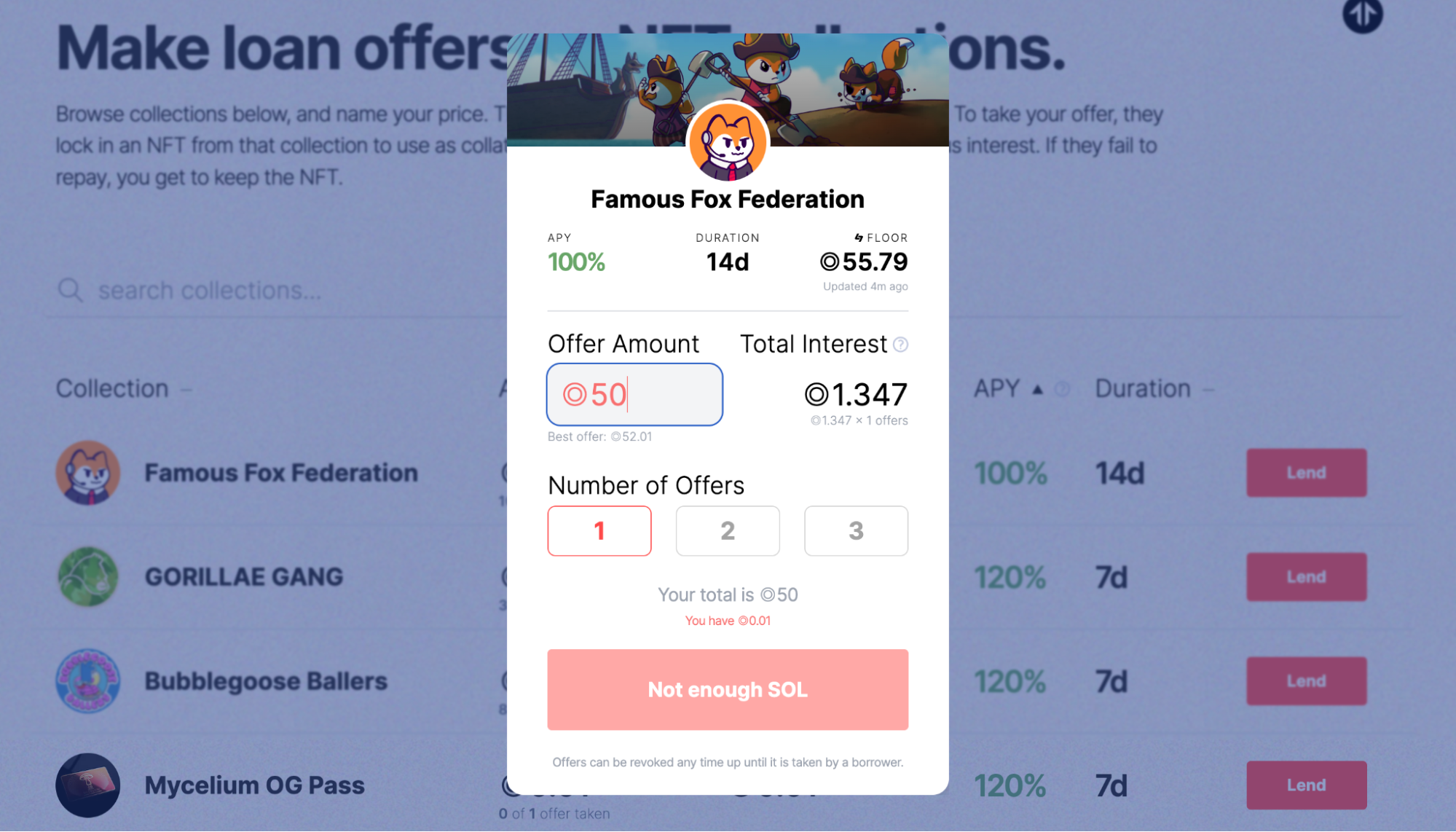

As for loan terms, Sharky loans range from seven to 16 days and have APYs between 100-360%. For example, a loan offer of 50 S◎L on Famous Fox Federation can net a return of more than 1.3 S◎L in two weeks. Not bad, huh?

For outsiders, Sharky might seem like another speculative decentralized finance (DeFi) protocol. It involves crypto, NFT-backed loans, eye-popping APYs, and the expectation of easy money. But below the surface is a team committed to making lending a win-win situation rather than a zero-sum game. Co-founders Rea Dulcetta and Anton Restuta aim to “give NFTs lasting power and the financial backbone to be assets that people won’t take lightly.”

It seems to be working.

Why use Sharky?

Get liquidity

Need crypto? Offer your NFT as collateral to get a loan for a can’t-miss trade or mint. While your NFT’s locked up, it’ll remain in your wallet so you can stay in your DAO, keep voting rights, and continue to get airdrops and event access. Just be sure to repay your loan, otherwise, you’ll lose your NFT to the lender.

Make passive income

If you’re fishing for another stream of income, Sharky could be an enticing option. It offers fin-tastic APYs and short turnaround times. Plus, if someone fails to repay your loan, you’ll get their coveted NFT (which will be worth more than the loan).

How to get started with Sharky?

Ready to get your feet wet? Here's what we recommend.

Make your first loan offer, but start small. Go to Lend to see the list of available collections. Then, filter the “Best Offer” tab from lowest to highest. You’ll see collections with offers that are less than 0.05 S◎L, and you may even see a collection “awaiting offers.” If so, make the collection’s first offer to increase your chances. If there aren’t any without offers, place low-stakes offers on the other collections. Either way, you’ll test the Sharky waters—without it costing you an arm and a leg.

Don't have a crypto wallet? Download Phantom to get started.